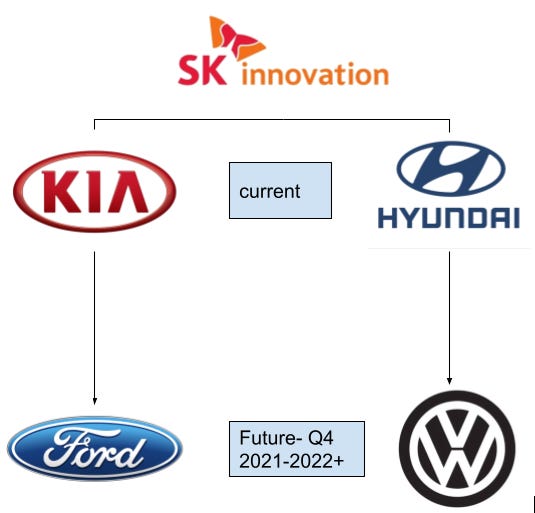

On February 10th the International Trade Commission announced that it has banned SK Innovation (SKI) from importing certain lithium ion battery components into the US for 10 years. This legal decision was made based on the ongoing investigation into whether SKI stole and used trade secrets from LG Chem, a leader in lithium ion battery manufacturing. This is very important news, because the batteries that were to be produced at this plant would supply the production of some American electric vehicles. SK Innovation had contracts to supply the electric Ford F-150 and an electric Volkswagen SUV that were to be assembled in Chattanooga, Tennessee.

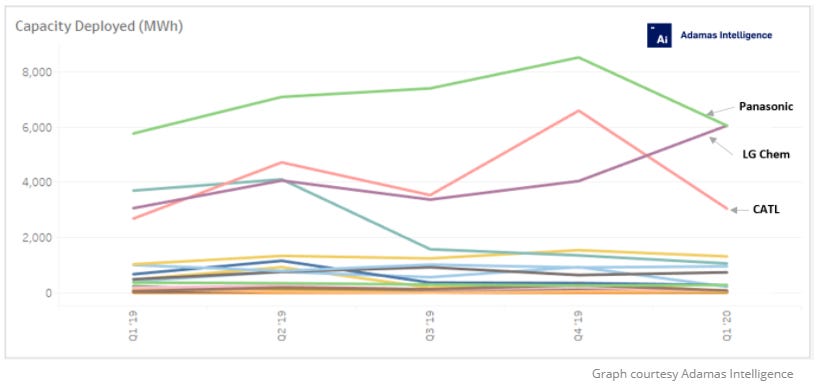

It is well known that the electric vehicle industry is scaling rapidly, but the rise of EVs has come after a long, arduous process of developing lithium ion batteries. The trade secrets that SKI stole allowed them to bypass a lot of difficult challenges that LG Chem faced over the past three decades. According to Navigant Research LG Chem is an established leader in the market, and The Company claims that trade secrets around R&D, Procurement, Manufacturing, Assembly, Quality Control, and Sales/Business were confiscated. LG Chem is part of the big 3 (LG Chem, Panasonic, and CATL) for global battery production and installation.

The Lawsuit

In the introduction it states “LGC expended billions of dollars to develop the LGC Trade Secrets and confidential information over the course of about 30 years. The significant investments of time and money resulted in LGC’s development of batteries that (a) are stable, strong and versatile, (b) can be produced efficiently and at a substantially lower cost than other products in the market, and (c) have evolved through vigorous testing and optimization with custom machinery and proprietary processes. As a result, LGC’s Trade Secrets and other confidential information have substantial independent economic value.”

Further, in 2016-2017 SKI was not one of the top six global cell suppliers. In 2021 SKI had a projected market share of about 2% while LGC was “expected to reach 30%.” LG Chem believes that many former employees specifically worked on products for Volkswagen automobiles and its MEB platform (modular electric toolkit). Volkswagen was one of LG Chem’s key and emerging customers.

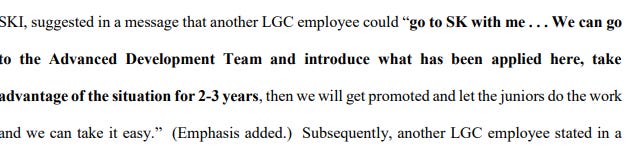

An excerpt from the lawsuit below tells the story.

The Employees Identified

Former LGC employees that were identified applied for the following positions at SKI around the same time frame. Employees one through six are listed.

Employee 1 - Worked at LGC from 2009-2018 and applied at SKI for position concerning advanced process research

Employee 2 - worked at LGC from 2011-2018 and applied to SKI for position in battery marketing. Defendants solicited and #2 provided detailed information regarding managing.

Employee 3 - worked at LGC from 2008-2017 and applied to SKI as scientist

Employee 4 - worked at LGC from 2010-2017 and applied to SKI concerning battery planning and operations.

Employee 5 - worked at LGC from 2011-2018. Applied to position about battery engineering, manufacturing, and formation.

Employee 6 - worked 2008-2018 - applied for position around advanced process research.

Messages, emails, and communications were gathered and analyzed. Specific questions were asked by former employees such as “How does the cooling work [former LGC employee]: The cell capacity is changed, so it’s becoming smaller. That’s what I want to know the most”.

Another employee who worked for the Global Manufacturing Process Team sent a message asking for information concerning what electrolyte LGC was using, which the LGC employee provided.

In claim 106, LGC determined that these employees “systematically raided LGC of 77 highly trained scientists, engineers, and business individuals during the 2016-2018 period.

What was Stolen?

When we consider all of the things that go into battery R&D, LG Chem lists them all out. In italics I put in my thoughts around each particular property.

Production efficiencies

Plant layout/design, throughput, blueprints

Improvements to battery life

Charge and discharge cycling, temperature

Performance and stability

Battery management

Software

Temperature control

Software

Leak prevention and design

Materials, pack design

Increased battery capacity and efficiencies

Formulation technique and application, equipment parameters and optimization

Energy regulation and charging rates

Software

Cost reductions

Weight and volume reductions

Quality control procedures

In-line process and physical property testing

Procedures for testing safety

In claim 56, LGC states that it “has developed valuable LGC Trade Secrets specifically for Volkswagen’s MEB platform.” SKI recently won a contract to produce the batteries for European models, so it seems oddly peculiar that they were able to secure this deal in a matter of 3-4 years of R&D.

What Batteries and/or Vehicles Could be Impacted?

There is information and belief that the 2019 Kia Niro EV, a crossover utility EV, contains Li-ion cells from SKI that applied LGC trade secrets.

Second, Volkswagen’s MEB battery products used LGC secrets. On Nov 13th, 2018 Volkswagen announced “that it has selected SK Innovation as a strategic supplier of battery cells for production of electric vehicles”. “Volkswagen’s battery supply contracts for electric vehicles have been estimated to amount to $40-50 billion through 2025.

Finally, as mentioned above the Georgia plant would likely supply Ford’s efforts on an electric F-150.

LGC was recognized as having 12% market share in the global EV battery market in 2015. At the same point SKI was not identified as a top 10 producer and had less than 2% market share. LGC now has roughly 23% market share, while the latest report from mid 2020 suggests SKI has only grown to 3.5%.

LGC is claiming that SKI garnered about 30 years worth of experience and expertise in about 2-3 years.

What is 30 years worth of battery experience? Have a look at the picture below, and think about how long it took to go from traditional AA/AAA batteries to today’s Li-ion cells. Does it make sense that SK Innovation was able to grow so quickly?

Where does the industry go from here?

There will only be more pressure and challenges for companies to retain trade secrets as electric vehicles are scaled globally. Gigafactory construction and mass production of batteries are precise and difficult engineering feats that require lots of inputs. We should expect the likes of LG, CATL, Panasonic, and Tesla to lead battery production into the future. We should critically analyze any small company, like SKI, given the cost and capital investment needed to make lithium ion batteries.

References:

LG Chem vs. SKI Lawsuit https://files.lbr.cloud/310916/import-LG-Chem-v-SK.pdf