The world needs energy; more and more of it. It is turning into a supply chain nightmare, but also a very lucrative business for the ones involved in the sustainable energy transition.

Fuel such as oil and natural gas is extracted from the Earth and used to generate heat and power vehicles and equipment. We are now entering a transition period of using equipment to harvest metals and compounds to produce products that store and harvest the Earth’s energy. Renewable energy (solar, wind, and hydroelectric) is becoming a larger and larger share of the world’s power generation.

The renewable energy industry is booming, and lithium ion batteries make up a large portion of its growth. Lithium is one of the most crucial elements needed for producing lithium ion batteries. In a traditional Li-ion battery lithium can constitute 7% of the total weight of NMC and/or LFP cathodes (reference 1).

Lithium pellets and foil (left to right)

Recently Bloomberg NEF released its forecast for lithium and other battery metals demand for the coming decade. It is obvious that demand is growing substantially with these metals expected to grow by an average of 5.5 times!

Bloomberg New Energy Finance includes some context and predictions on each individual metal in this write-up. Batteries use all of these metals, and with recent announcements from major auto manufacturers we are facing an all hands-on deck situation to mine and extract as fast as possible.

Everyone wants to build Gigafactories

Ambitious plans are being laid out by companies to procure lithium and use it to produce lithium ion batteries. Whether it be automotive, aerospace, or personal technology companies, the demand is continuing to increase.

There have been many companies announcing plans to build battery production plants (gigafactories) throughout the world. Volkswagen announced plans to sprawl across Europe during its Power Day.

The pipeline is also plentiful in the United States with a nice graphic recently shared on Twitter @LMCAutomotive. Asian companies are beginning their global expansion into the Western world with companies such as SK Innovation and LG Chem planning to build plants in the Midwest and Southeast.

Uncoincidentally, we have started to see price spikes in the raw materials used to make lithium (hydroxide and carbonate) as reported by Benchmark Mineral Intelligence.

On quick glance it appears that the price of LiOH (lithium hydroxide) and Li2CO3 (lithium carbonate) should be manageable in a rising price environment as the price is still 50% lower than that of 2018. I believe the challenge will be in transportation and shipping of these materials. The world is experiencing a shortage of truckers and shipping staff for moving and delivering goods, so lithium buyers may be forced to pay premiums for guaranteeing shipment.

Rather than go into the weeds of exactly how the shipping supply chain will respond, it goes without question that demand growth for these metals will require adaptation and innovation in the transportation industry.

2 Forms of Lithium - LiOH and Li2CO3

Receiving lithium is only the first step. Lithium has high purity standards for the automobile industry, and if it is to be commercialized in solid state batteries it gets more technical.

Lithium is produced from brine evaporation ponds (salars) or direct mining of lithium containing rocks such as spodumene.

Carbonate

Brine reservoirs are processed by pumping underground salt-rich waters into evaporation ponds (photo above). Evaporation occurs and leaves high concentrations of lithium chloride. When the concentration reaches a sufficient level it is pumped to a recovery plant where other trace metals are washed and filtered out. It is then treated with lithium carbonate to precipitate out more carbonate.

Mined lithium from spodumene and other rocks is a much more costly and energy intensive process. The rocks are heated to roughly 2000 degrees Fahrenheit and then cooled. It gets crushed and roasted again with sulfuric acid to wash off trace metals. Sodium carbonate is again added to precipitate out more lithium carbonate.

Hydroxide

Lithium carbonate can then be used to make lithium hydroxide. Calcium hydroxide is added to carbonate to form calcium carbonate (solid) and a lithium hydroxide solution.

Depending on the specific use case determines which form of lithium is used. Lithium hydroxide and lithium carbonate have different physical properties that determine their application and use in different formulations. Carbonate has two atoms of lithium per mole, while hydroxide has one atom of Li per mole. The melting point of hydroxide is 462C, while carbonate is 723C.

They are used to produce lithium metal oxides for cathode active materials. The synthesis of these materials is highly technical, and I would recommend listening to the Global Lithium podcast with @DrYuanGao where they talk about why LiOH is preferred for high nickel active materials.

An excerpt from Argus Metals states that “as nickel content approaches 60pc, the higher temperature required to synthesise cathode material with lithium carbonate damages the crystal structure of the cathode and changes the oxidation state of the nickel metal. But lithium hydroxide allows rapid and complete synthesis at lower temperatures, increasing the performance and lifespan of the battery, said Marina Yakovleva, global commercial manager for new product and technology development at lithium producer Livent.”

Clearly, it is not as easy as extracting typical fuels such as oil and gas. Lithium is obtained by filtration, while oil and gas are simply heated to boil and distill out lighter components. The oil and gas industry is also well established and built into the global infrastructure.

What Happens Next?

Every company has a roadmap to producing renewable and/or sustainable products, but is it possible for everyone? Bloomberg NEF suggests that lithium mining should keep up with demand, but it will not come without its challenges.

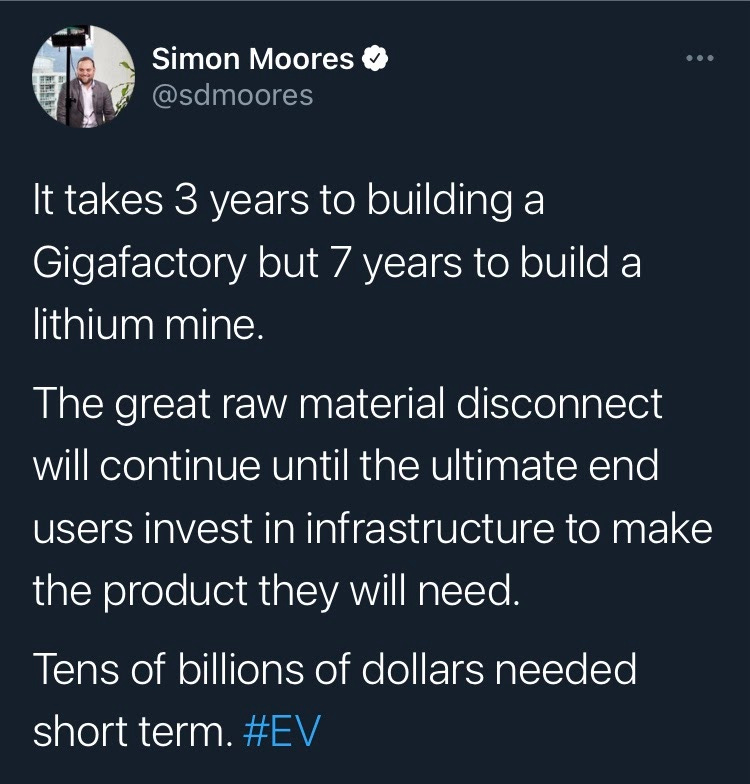

Simon Moores of Benchmark Mineral Intelligence on the other hand does not seem as optimistic.

Until someone makes a big innovation in the production of lithium we will most likely face a bottleneck.

James Marshall initiated the Gold Rush in 1848, which lasted for about seven years. The crude oil discovery in 1875 initiated what is the foundation for today’s global economy. Now, the global move to produce sustainable materials and products has put the Lithium Rush into top gear. Buckle up!

References: